In previous articles, we have told you in detail about the phenomenon of “correlation”. Today we will give you several examples related to the correlation between cryptocurrencies, which could be observed in 2018 and 2019.

Correlation between cryptocurrencies

By the end of 2017, cryptocurrencies reached the maximum price value. Bitcoin cost, more than 20 thousand dollars, Ethereum – more than $ 1000. Experts identify several reasons for what happened. Firstly, investor interest. Everybody was talking about cryptocurrencies. It was believed that Bitcoin is a good tool for receiving large dividends, so people willingly invested their hard-earned money in this area. The same goes for initial coin offerings (ICOs). At that time, this topic was also at the peak of popularity.

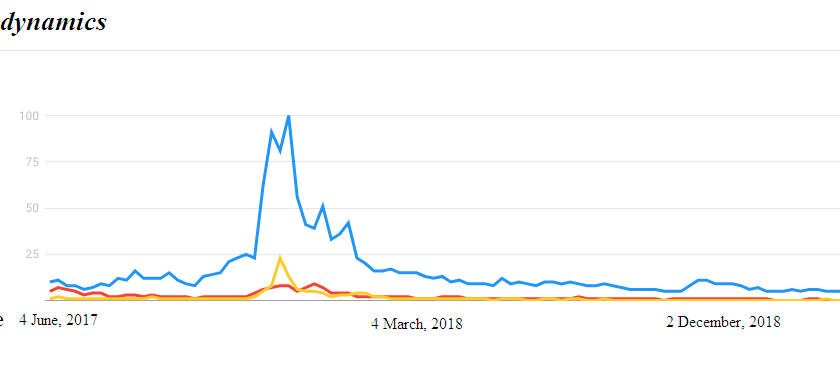

A graph of the popularity of some cryptocurrencies is presented below. The blue line is the popularity of the Bitcoin request, the red one is Ethereum and the yellow one is Litecoin.

However, experienced analysts believe that there was another reason for such an unprecedented growth of coins. This is about the alleged manipulation of the Bitfinex exchange. It released altcoin Tether. With its help, it was possible to artificially increase the Bitcoin exchange rate. So says John Griffin, a professor of finance (University of Texas). It is worth noting that immediately after the New Year, the Bitcoin exchange rate fell below the mark of 10 thousand dollars and for a long time it didn’t rise.

New Mining Managing Partner Stepan Gershuni has a different opinion.

«In my opinion, the reason for the increase in prices for cryptocurrencies in 2017 is the market hype. With the growth of coins in value, people have a fear of missing important events happening here and now. Panic forces them to urgently buy coins, after which the rate begins to grow rapidly, reaches its limit and at one point everything begins to crumble. The reason is a serious deviation from the trend line. This turn of events took place at the end of 2017. Now the same thing is happening. There is no doubt that the scenario will be repeated. At the stage of formation, Bitcoin had 2 more such cases: in 2011 (correction from $ 25 to $ 5) and in 2013 (from $ 1000 to $ 100). By the way, in 2018, the rate fell from $ 20,000 to $ 3,000».

What happened in 2018?

The Bitcoin exchange rate has begun to plummet. When he reached the mark of 6 thousand dollars, experts unanimously declared that the bottom had been reached. But the coin continued to lose in value. For a long time, the rate of “digital gold” ranged from 3 to 4 thousand dollars. It simply could not go lower, since the cost of mining the coin was 3.4 thousand dollars.

At the end of last year, the complexity of Bitcoin mining decreased, so miners living in countries where electricity is expensive, or having old imperfect equipment, were forced to suspend work due to unprofitability. In many ways, it was this factor that predetermined the value of bitcoin at that time.

What awaits the coin by the end of this year?

According to Gershuni, the situation could be repeated in the same way as in 2017. The Bitcoin exchange rate can soar up to 30 – 50 thousand dollars, but then it will begin to roll back anyway. The real price of “digital gold” is 3 thousand dollars. Therefore, what is happening now is nothing more than a fluctuation in rates.

What other factors are affecting Bitcoin growth right now?

- Better infrastructure. The number of legal exchanges is only growing every year, it has become much easier to purchase coins. They can easily be bought even for cash.

- Large investors are still on the market. Despite the long recession, they did not go anywhere, but simply took a wait and see attitude.

- Technology has become more common. The business of many countries is gradually starting to work with cryptocurrencies. In Australia, for example, in a small town, as an experiment, all payments were made using cryptocurrency. Some chains of restaurants and cafes began to accept them for payment along with cash and bank cards. Such implementations cannot but affect the exchange rate of coins, at least insignificantly.

One of the main reasons why Bitcoin is still stable is its limited emission. There can be no more than 21 million bitcoins mined, so the demand for them is constantly growing. And the number of people who use bitcoin wallets is increasing every year. In the first quarter of 2019, 35 million wallets were registered, while in the same period of 2018, 11 million less wallets were registered.

And in conclusion

Today we talked about the features of the correlation between cryptocurrencies in recent years. As you can see, there are certain patterns. Of course, external factors also influence. But we will dwell on them in more detail next time.

This article is not a recommendation for investment or investment in cryptocurrencies, as well as perceived as investment advice. Be careful, because investing in cryptocurrencies is very risky and you need to consult with your financial advisor. Past earnings do not guarantee future earnings.

Holderlab.io is a fully automated cryptocurrency portfolio management laboratory. Analysis of the cryptocurrencies correlation, searching for the optimal cryptocurrency portfolio weights. Uses crypto trading bots and the auto efficient crypto portfolio index.

Follow Holderlab.io on

Twitter: https://www.twitter.com/gotoholderlab

Facebook: https://www.facebook.com/holderlab/

Telegram: https://t.me/holderlab

Our blog: https://www.blog.holderlab.io/

Website: https://www.holderlab.io