So let’s talk about cryptocurrency correlation analysis. In our previous materials, we focused on the prospects for creating a cryptocurrency portfolio and how to form it. We have repeatedly said that the value of most coins depends on the value of bitcoin. This factor is very important in the formation of the portfolio, and we will discuss this in more detail.

Cryptocurrency correlation.

To do this, we introduce a term such as “correlation”. Correlation is a market situation in which one asset repeats the movement of another asset. The dominant position now is Bitcoin. Coins such as Ethereum, Litecoin, Ripple and others are subject to fluctuations when the value of “digital gold” changes.

The range of correlation changes is from -1 to +1. Three scenarios are possible:

The correlation coefficient is +1. The movement of two coins occurs absolutely synchronously, that is, a change in one of them in price, due to some external factor (for example, a sharp drain of assets from large holders, hacking of the exchange or sanctions on an asset by a large state), leads to an inevitable change in the price of the second.

The correlation coefficient is 0. Assets move relative to each other independently, that is, a change in the price of one of them doesn’t affect the other coin.

The correlation coefficient is -1. The movement of assets is carried out in opposite directions, that is, an increase in the price of one of them leads to a decrease in the other (in the same percentage).

An example of a cryptocurrency correlation.

Here we need to give a more vital example for you. With the growth of income, the value of real estate becomes higher due to greatly increased demand. This is an example of a positive correlation. With wasted time, your academic performance is low. The more time is spent, the lower the performance. Here we already see a negative correlation.

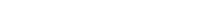

Look at the correlation table below. This calculation is carried out with the help of backtesting in the service Holderlab.io

You can see the degree of correlation of sixteen digital currencies with the highest market capitalization. The period in question is 3 months. However, the value of the correlation coefficient decreases, for example, the correlation matrix for 1 year shows a decrease in the average value by 0.2.

It’s easy to see that almost all the coins are positively correlated. This tells us that external factors somehow affect the value of each asset. Somewhere – to a greater extent, somewhere – to a lesser extent.

3 months cryptocurrency correlation matrix.

If we

We have already said that today Bitcoin is the main digital asset. Let’s evaluate the degree of its correlation with some assets in more detail.

Ethereum.

In the short term, the correlation is very high (0.7 – 0.9). But with an increase in the period, it begins to fall (an example was given above), since the monthly delay factor

Fig. 2. The dynamics of the value of Bitcoin and Ethereum for six months

Litecoin.

Both coins have the same pricing mechanism. Let’s say even more: Litecoin was created as an improved version of bitcoin (that is, without its obvious shortcomings). When creating Litecoin, the Bitcoin blockchain was used, therefore it is not surprising that with rare exceptions (for example, while waiting for the SEC decision), the accuracy of the correlation of the two assets is quite high.

Ripple.

There is a less pronounced correlation, although it is definitely visible. The main difference is that the coin reacts more calmly to changes in the market.

The second point, which is visible from the table, is the inverse correlation of cryptocurrencies to the fundamental indicators listed above. It clearly shows us a negative dependence on the US stock market S & P500 and on the VIX volatility index. However, the dependence on gold is minimally positive.

Conclusion.

To summarize of cryptocurrency correlation analysis the above, it can be noted that when forming a cryptocurrency portfolio, it is important to take into account the degree of correlation of one coin from another. It is best to acquire digital assets that have a low positive or negative correlation coefficient. This will help you protect the portfolio in case of negative external or internal factors (for example, a coin was found to be vulnerable).

You might have a reasonable question of whether there is a correlation between the cryptocurrency and the traditional market. We will talk about all this in our next article. Do not miss! Thank you for reading this article about cryptocurrency correlation analysis.

This article is not a recommendation for investment or investment in cryptocurrency, as well as perceived as investment advice. Be careful, because investing in cryptocurrencies is very risky and you need to consult with your financial advisor. Past earnings do not guarantee future earnings.

Holderlab.io is a service for automated crypto portfolio management with automatic rebalancing of assets (threshold or periodic), searching for efficient frontier and analysing assets using a correlation matrix and other crypto investments tools.